Feel free to leave your vote:

2

Share template with others

Summary

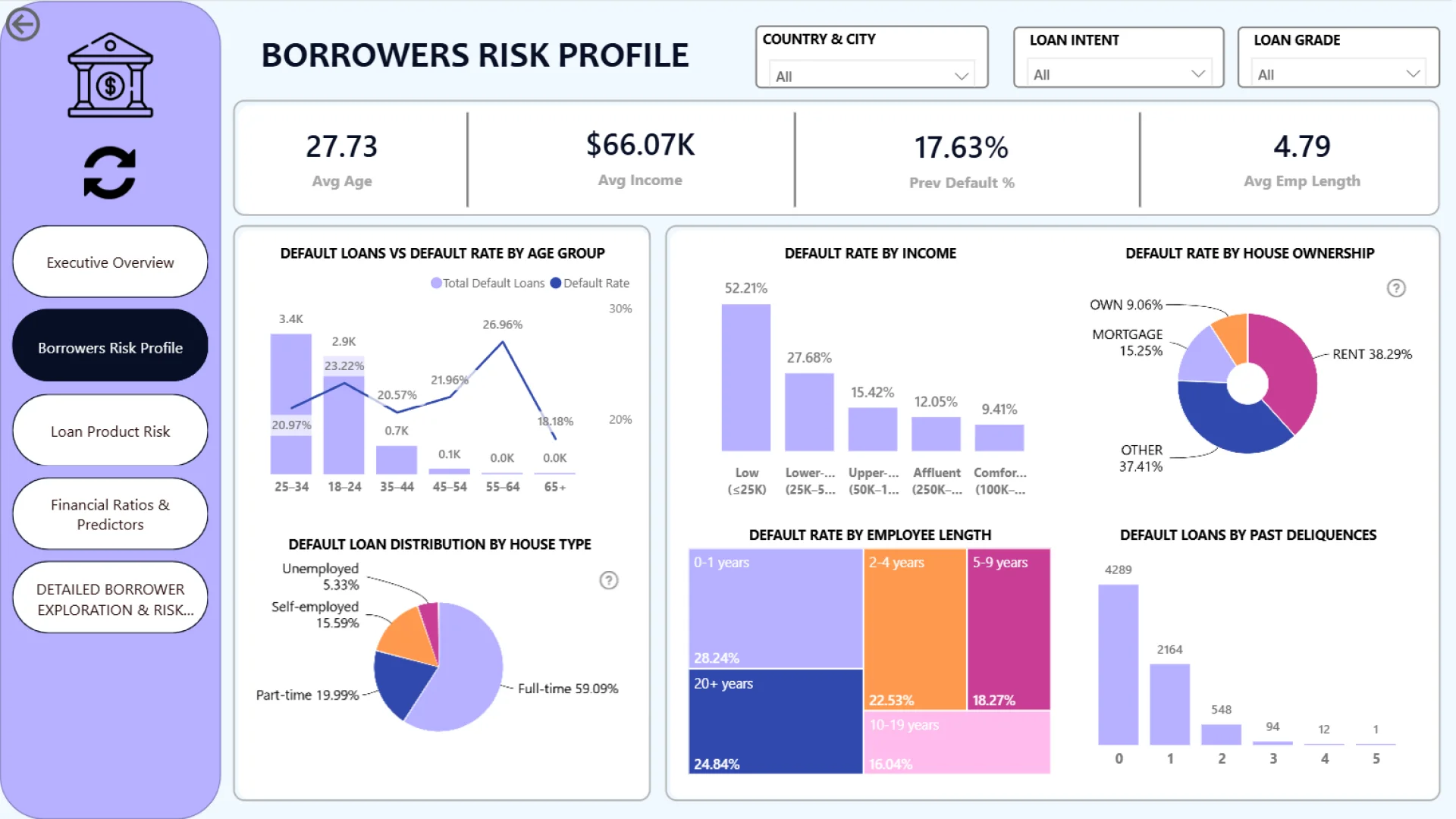

This Power BI report uses the Credit Bank Risk Dataset and features ZoomCharts Drill Down PRO custom visuals for Power BI. It was submitted to the Onyx Data DataDNA ZoomCharts Mini Challenge in September 2025.

Author's Description:

This Power BI report provides a comprehensive analysis of credit risk to help Nova Bank make informed and balanced lending decisions. By examining borrower demographics, financial indicators, loan characteristics, and repayment outcomes, the report uncovers key patterns that influence the likelihood of loan default. The analysis highlights several critical insights. Borrowers with a debt-to-income ratio above 0.6 are significantly more likely to default, indicating that debt burden is a strong predictor of repayment behavior. Longer loan terms (e.g., 60 months) are associated with higher default rates, while borrowers with shorter credit histories show increased risk compared to those with established credit records. Additionally, previous default history substantially raises the probability of future defaults, and Grade G loans, although fewer in number, exhibit extremely high default rates (\~98%). The dashboard uses interactive visuals and key performance indicators to make these patterns easy to explore and understand, enabling Nova Bank to identify risky borrower segments, refine lending policies, and enhance overall credit decision-making.

Mobile view allows you to interact with the report. To Download the template please switch to desktop view.